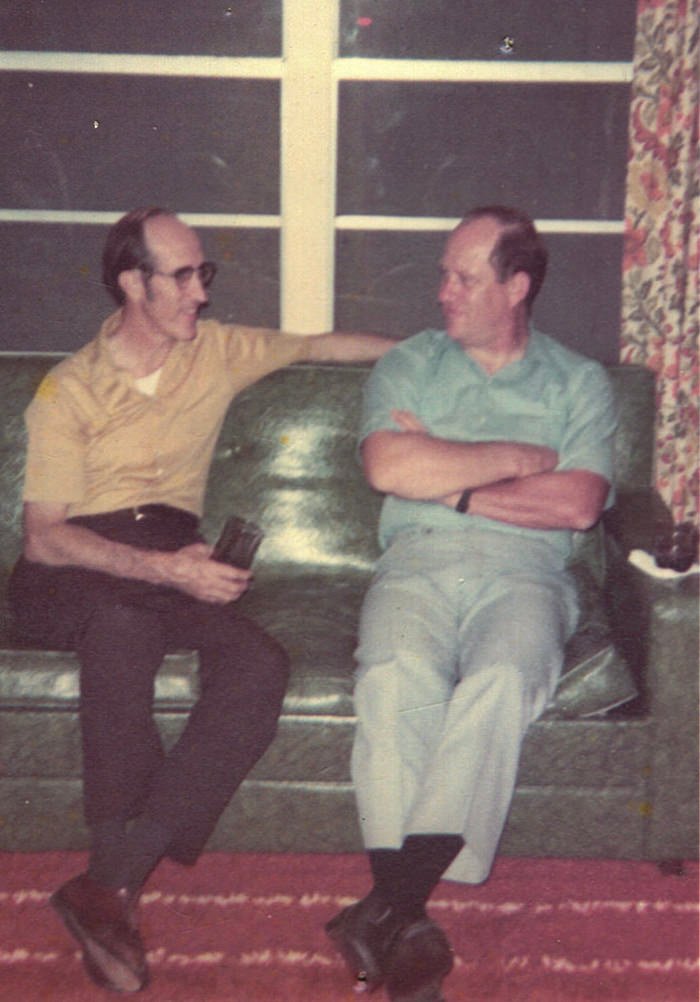

Bob Foos and Katy Schrader

An open-house will be held Friday to celebrate Roderique Insurance Agency’s 80 years in business.

The event will also be an opportunity to welcome Smith Insurance, another family-owned agency which has purchased Roderique Insurance.

Pam Drake, granddaughter of Francis and Bernice Roderique, who founded the business in Carterville in 1945, has been a part of the business for 46 years and owned it since 1989. She announced to her customers last month that after much thought she had decided to sell the business.

She accepted the offer from Monty and Peggy Smith, of Nevada. Monty, an agent for 22 years, started Smith Insurance in 2015 and was later joined in the business by Peggy.

Their son-in-law, Jonny Davis, will be in the Webb City office every day.

Pam has been hired to help Jonny on a part-time basis during the transition. She’s looking forward to taking a couple of days off each week to mostly enjoy being with her grandchildren.

Current policies will remain in force. The same companies Pam has used will be available, as well as others used by Smith Insurance.

The open house, with a prize drawing and other giveaways, will be from 9 a.m. to 4 p.m. at 108 N. Main St. There will be a pulled-pork lunch served from 11:30 a.m. to 1 p.m.

Katy Schrader, a former Sentinel assistant editor, interviewed Pam Drake about her company’s history when Roderique Insurance celebrated 50 years in business in December 1995.

Roderique Insurance Agency got its start in 1945 when Francis and Bernice Roderique set up in the back room of their home on Main Street in Carterville.

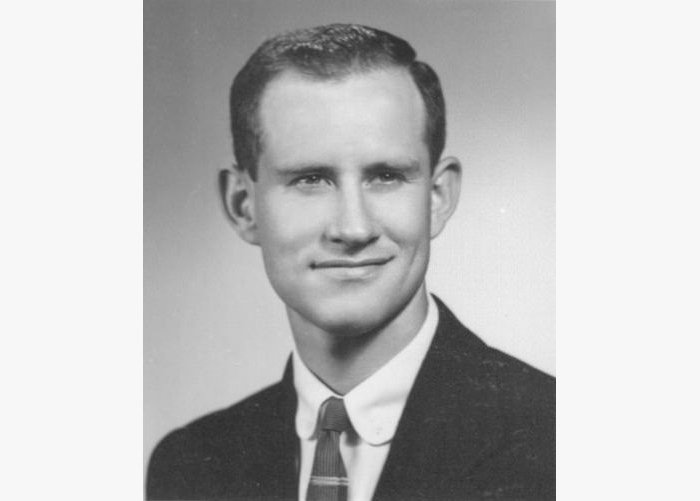

When Francis Roderique died in 1963, Pam’s father, Don, took over and as she says, “Just put his heart and soul in it.” Under Don Roderique, the agency relocated to 112 N. Webb St. and then to 28 S. Main St.

Pam’s brother, Jim, took over in 1978 when their father died. In 1982, the company relocated to 108 N. Main St.

Today, Drake credits her father – a two-term member of the Missouri House of Representatives – for building a strong foundation on which the business has been able to grow. She believes he practiced clean and honest business practices the same way he campaigned for clean and honest government.

“Those 15 years he worked the business, he built the business up,” says Pam. “My father was a tremendous person. The personal side of “the business” is probably what has been retained – plus Dad’s reputation. People still come in to this day and say, ‘Boy, your dad was a wonderful man.’”

It was the summer before her senior year in high school that Pam wandered into what eventually became her career. Under her brother’s tutelage, she began learning the insurance business while working as a secretary. She finally went full-time at the agency after graduation and earned her agent’s license several years later.

At one point, Pam says her brother considered shutting down the business. Instead, he eventually left and passed the chain of command to Pam in 1987. Pam remembers that her mother, Jenell, strongly opposed the idea of closing the agency.

“For her, it was a part of Dad that she would never, ever let go. Maybe that was her way of keeping him alive,” says Pam.

With her mother’s death in 1992, Pam is left to carry on the family business. Should she ever leave, she has two sons and several nephews and nieces who could get involved with the business. But for now, she’s right where she wants to be. One of her biggest pleasures is serving customers who have been with the agency since its beginning.

Aside from the agency’s long history of owners and locations, there are other signs that time has passed and things have changed. Recently, Pam said she stumbled across a pocket-size memo book, dating back to 1945, in which her grandparents kept hand-written records of policy holders and premiums. Although Drake marvels at the hand-written record-keeping practices, it was the cost of insurance that really piqued her interest. Som of the premiums were priced as low as $50 per year.

“It just blows my mind,” she says.